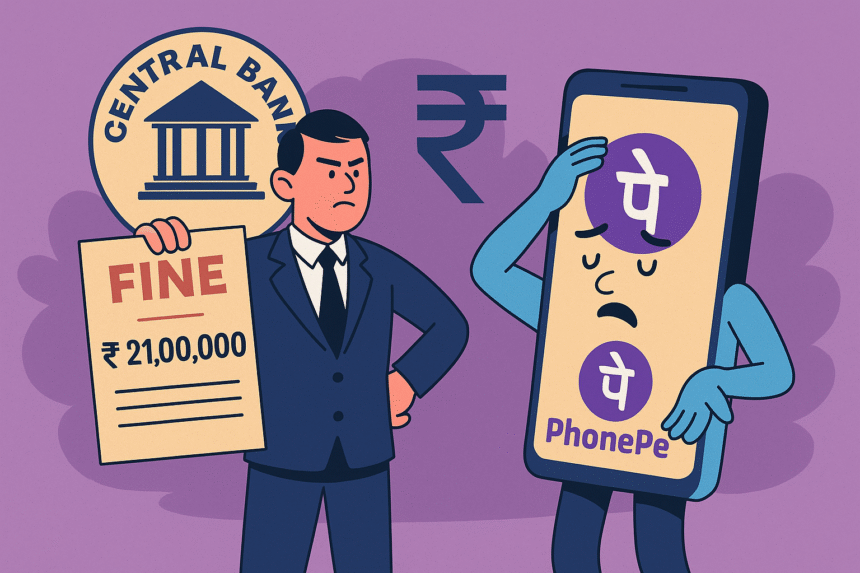

RBI fines PhonePe ₹21 lakh for escrow account lapses. Here’s why the penalty matters, what RBI said, and how it impacts PhonePe’s IPO.

So, PhonePe just got a ₹21 lakh bill from RBI. Not for shopping on Flipkart, not for bingeing on Swiggy, but for—wait for it—forgetting to keep enough money in its piggy bank. Yes, the Reserve Bank of India (RBI) caught them short, and let’s just say, RBI doesn’t “split the bill.”

The Fine Print (literally ₹21 lakh worth)

The Reserve Bank of India (RBI) has fined PhonePe ₹21 lakh for failing to follow prepaid payment instrument (PPI) rules. A PPI is basically like a prepaid wallet—you load money into it and spend from that balance, instead of dipping directly into your bank account.

But here’s the twist: RBI found that on some days, PhonePe’s escrow account balance was lower than the money it owed customers and merchants. Think of it as having 100 guests at a wedding but only cooking food for 80. Not a good look.

For those new to the term, an escrow account is like a safe vault managed by a neutral third party. Payment firms must keep customer funds there so money is safe and used properly.

👉 Even RBI’s official guidelines spell out how escrow accounts must always match outstanding balances.

Why RBI slapped the fine

The penalty followed a statutory inspection of PhonePe’s books from October 2023 to December 2024. The inspection revealed that PhonePe’s end-of-day balances were sometimes lower than the outstanding PPIs and payments owed.

Adding salt to the wound, PhonePe also failed to report the shortfall to RBI immediately. RBI, being RBI, didn’t just sit quietly. They sent a notice, asked for explanations, considered PhonePe’s reply and oral submissions, and then decided: “Yep, guilty as charged. That’ll be ₹21 lakh, please.”

Punchy one-liner: When RBI says “Pay up,” even the “PhonePe” must pay!

What RBI clarified

Before you panic about your wallet, relax. RBI clarified that the penalty was not about customer money being unsafe. Instead, it was about regulatory lapses and compliance gaps.

So, your chai payments, Zomato orders, or that Netflix subscription you forgot about? All safe. The fine is more of a “do better next time” tap on the wrist than a full-on smack.

Timing couldn’t be worse

Here’s the juicy part: this fine comes just as PhonePe gears up for its IPO in 2025. The company has big plans to list with the help of Kotak Mahindra Capital, JPMorgan Chase, Citigroup, and Morgan Stanley.

Imagine planning a big wedding and getting fined by the city council for not having enough chairs. Not a showstopper, but definitely awkward.

👉 Even Economic Times has been buzzing about RBI’s increased scrutiny of payment firms lately.

Why this matters for fintech in India

This isn’t just a PhonePe story—it’s a reminder that RBI has tightened its grip on digital payment companies.

- Escrow vigilance: RBI is watching those accounts like a hawk.

- Reporting requirements: Any slip-ups? Report immediately or face fines.

- IPO impact: With PhonePe eyeing billions in valuation, every compliance misstep will be magnified.

In short, RBI wants fintech firms to grow, but responsibly.

PhonePe’s response (or lack thereof)

While PhonePe hasn’t made a dramatic statement yet, the company is expected to smooth things over quickly. After all, ₹21 lakh is pocket change for a unicorn valued at over $12 billion.

Still, the fine acts as a warning. Even the biggest fintechs can’t afford to cut corners with compliance.

So, what’s next?

- PhonePe IPO Watch: Investors will keep a close eye on how PhonePe addresses compliance lapses before its market debut.

- Stricter RBI checks: Other payment firms like Paytm, Google Pay, and Amazon Pay may face tighter scrutiny.

- Consumer confidence: Thankfully, your wallet stays unaffected. But confidence depends on how transparent companies are about such issues.

In the world of fintech, trust is the currency—fines are just the late fees.

What do you think—should RBI go harder on fintech lapses, or is a ₹21 lakh fine enough of a warning shot? 💬 Drop your thoughts below, share this with your fellow digital-wallet warriors, and don’t forget to check out our other takes on India’s growing fintech drama.

Suggested Related Post

“Why Jio and Airtel Rule While BSNL & Vi Struggle”