RBI launches the offline e₹ — India’s new digital rupee that works without the internet. Learn how it works, and why it’s a game-changer.

- 💡 What’s This e₹ Thing Anyway?

- 🏦 Where Can You Use It?

- 💰 How Does the Offline Magic Work?

- 🔓 No Bank? No Problem.

- 🌍 Who Benefits the Most?

- 🏦 Which Banks Are On Board?

- ⚙️ How To Get Started

- 📊 Why This Is a Game Changer

- 🧠 The Real Power Move by RBI

- 💬 Expert Take

- 💬 When Will It Be Fully Live?

- 📈 FAQs (Featured Snippet Friendly)

- 💬 The Meme Angle (Because Nokjhok Can’t Resist 😎)

- 📢 Call-to-Action (CTA)

- 🧩 Related Post Suggestion

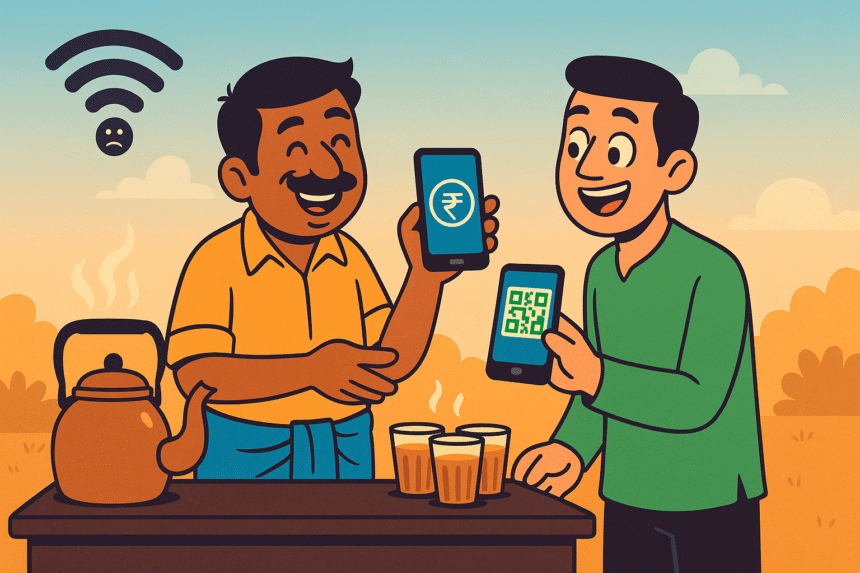

“Network gaya, payment gaya” — not anymore!

RBI has just dropped a desi digital bombshell at the Global Fintech Fest 2025 in Mumbai — the offline digital rupee (e₹).

Yes, offline. That means even if your 4G becomes 0G, you can still buy chai, recharge your metro card, or pay for pani-puri like a digital boss.

💡 What’s This e₹ Thing Anyway?

The e₹ (digital rupee) is India’s Central Bank Digital Currency (CBDC) — think of it as your regular ₹ but living in your phone instead of your wallet.

It’s not a new cryptocurrency or UPI 3.0 — it’s official RBI money, just in digital form.

You can use it without the internet, store it in your digital wallet, and spend it just like cash.

(According to RBI’s official circular, e₹ will be accepted nationwide — opens in new tab)

🏦 Where Can You Use It?

Anywhere! From your favourite samosa stall to a high-end boutique.

All you need to do is scan or tap any QR code, even if your phone has zero signal.

💬 Imagine this:

You’re in a remote hill station. No Wi-Fi, no bars, just birds. But the chai guy takes e₹. You tap. Payment done.

Cash is officially jealous.

💰 How Does the Offline Magic Work?

Here’s the fun tech bit (don’t worry, we’ll keep it simple):

- e₹ works through NFC (Near-Field Communication) — so two phones can talk without internet.

- Your digital wallet stores rupees locally.

- You tap, the phones exchange cryptographic hellos, and boom — money moves.

No servers, no waiting, no “OTP expired” moments.

🔓 No Bank? No Problem.

To use e₹, you don’t even need your bank to approve every transaction.

Just download the RBI’s authorized e₹ app (available on Google Play Store or Apple App Store), register once, and you’re set.

Your digital wallet will work independently, like cash that fits in a smartphone.

🌍 Who Benefits the Most?

This move is pure gold for people in rural and remote India, where mobile signal is often a myth.

- Villagers can pay for seeds, milk, or bus tickets — no internet drama.

- Street vendors can accept payments without worrying about network drops.

- Even disaster zones can still run cashless transactions.

Essentially, RBI just made Bharat ready for offline fintech.

🏦 Which Banks Are On Board?

All the big boys are here:

SBI, ICICI Bank, HDFC Bank, IDFC First Bank, Axis Bank, Union Bank, Canara Bank, PNB, Bank of Baroda, Kotak, IndusInd, Yes Bank, Federal Bank, and Indian Bank.

If you’ve got an account in any of these — congratulations, your phone is about to turn into a wallet that works without Wi-Fi.

⚙️ How To Get Started

- Download the e₹ app from Play Store or App Store.

- Register using your Aadhaar and mobile number.

- Load money into your e₹ wallet from your bank.

- Tap to pay, even offline!

That’s it. No internet, no OTP, no awkward “wait bhai, signal nahi aa raha” moments.

Internet off? No problem. RBI just made your phone a wallet with superpowers.”⚡📱

📊 Why This Is a Game Changer

| Feature | Traditional UPI | Offline e₹ |

|---|---|---|

| Internet needed | ✅ Yes | ❌ No |

| Linked to bank | ✅ Yes | ❌ Optional |

| Works in remote areas | ❌ No | ✅ Yes |

| Settlement type | Real-time online | Instant offline |

| Backup when servers crash | ❌ Nope | ✅ Always works |

The e₹ doesn’t replace UPI — it complements it.

Think of it as cash meets QR code.

🧠 The Real Power Move by RBI

This launch shows how India is shaping the global future of digital money.

While the West still debates CBDCs, we just launched one that works in airplane mode.

It’s fast, simple, and most importantly — Indian jugaad approved.

💬 Expert Take

Economists call it “a leap for financial inclusion.”

Fintech startups call it “a new playground.”

And we call it — “UPI’s cool offline cousin.”

The RBI governor even said, “This will help bridge the digital divide and enhance payment resilience.”

Translation: even if the internet goes down, the economy won’t.

💬 When Will It Be Fully Live?

The pilot is already rolling out with select banks in major cities and rural test zones.

Expect a nationwide rollout by mid-2026 if things go as planned.

So soon, you’ll be paying for pani-puri or petrol without worrying about “no network.”

First came Paytm, then UPI, now RBI said — hold my chai. ☕💸

📈 FAQs (Featured Snippet Friendly)

Q1. What is the RBI’s offline digital rupee (e₹)?

It’s India’s official digital currency launched by RBI, usable for payments even without internet or mobile network.

Q2. How is it different from UPI or Paytm?

UPI needs internet and a linked bank account. The e₹ works offline like digital cash, stored in your mobile wallet.

Q3. Can I use e₹ without a bank account?

Yes. Once your wallet is set up, you can make transactions directly without linking to your bank every time.

Q4. Will rural users benefit from e₹?

Absolutely. The offline feature makes it ideal for areas with poor or no connectivity.

Q5. Is e₹ safe?

Yes. It’s issued by RBI, backed by government security protocols, and uses encrypted offline transfers.

💬 The Meme Angle (Because Nokjhok Can’t Resist 😎)

- “Cash is like your ex — unreliable. e₹ is the new loyal one.”

- “No signal, no stress. RBI understood rural heartbreaks.”

- “Offline payment = India’s new superpower.”

📢 Call-to-Action (CTA)

So next time your internet ghost-drops in the middle of a UPI payment, just smile — the e₹ has your back.

Tag that friend who still carries ₹10 coins “for safety” and tell them:

“Bhai, ab RBI ne bhi offline ho ke online kar diya!”

Follow @Nokjhok_Official for more witty takes on finance, tech, and everything that deserves a meme.

🧩 Related Post Suggestion

“RBI fines PhonePe ₹21 lakh: What went wrong”