Large-cap mutual funds lagged benchmarks with 13.6% returns vs Nifty TRI’s 14.7% over 3 years. Why alpha is shrinking and ETFs gaining ground.

Remember when large-cap mutual funds were the star performers, effortlessly beating benchmarks and bragging about “alpha”? Well, it seems those glory days are over. In recent years, these giants have stumbled, delivering less than the very indices they’re supposed to outperform. Think of it like Sachin Tendulkar suddenly struggling to outscore the team average—still dependable, but not the match-winner you hoped for.

The Big Picture: Alpha on a Diet

Between January 2020 and July 2025, large-cap funds delivered 13.6% over three years and 12.9% over five years. Sounds decent, right? But here’s the catch: the Nifty Total Returns Index (TRI) returned 14.7% and 14.1% over the same periods.

Translation: the so-called “active” funds are trailing behind a passive benchmark that simply sits there and reflects the market.

For perspective, back in 2000–2009, large-cap funds easily beat the benchmark by 4–5%. Even in 2010–2019, they still managed to stay ahead, though margins shrank. Today? They’re struggling to even match it.

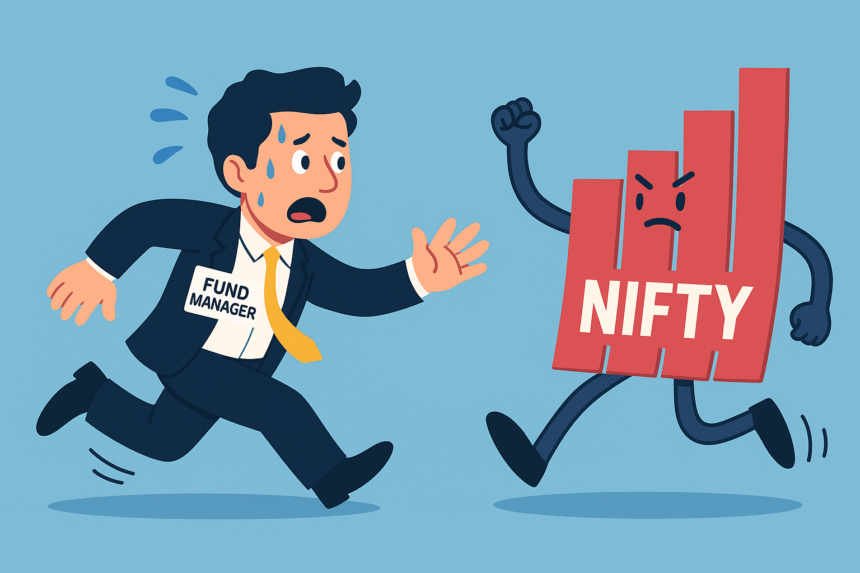

Why the Sudden Struggle?

The biggest culprit is SEBI’s recategorisation rules. Since 2018, large-cap funds have been required to invest at least 80% of their portfolio in the top 100 stocks by market capitalisation. That sounds neat, but it has unintended consequences.

- Limited Universe: With only 100 stocks to pick from, there’s less room to play smart. Everyone’s fishing in the same pond.

- Hugging the Benchmark: To avoid taking extreme risks, many large-cap funds stick too close to the Nifty 50 or Sensex. Result? They start looking like expensive index funds.

- High Costs: Active funds still charge higher expense ratios—often between 75 bps to 200 bps—while ETFs or index funds do the same job at a fraction of the cost.

As Harshvardhan Roongta, a market expert, quipped: “When you limit the playground, don’t expect too many sixes.”

Rolling Numbers Tell the Tale

Let’s look at the data:

- 3-year rolling returns (2000–2009): Large-cap funds: 25.8% vs Nifty 21.3% → Alpha of +4.5%.

- 2010–2019: Funds: 12.1% vs Nifty 11.0% → Alpha of +1.1%.

- 2020–2025: Funds: 13.6% vs Nifty 14.7% → Alpha of –1.1%.

The story is clear—alpha is shrinking, and now it’s even negative.

Passive Investing Steals the Show

With large-cap funds losing their edge, ETFs and index funds are becoming the go-to choice. Investors are waking up to the reality that paying high fees for underperformance makes little sense.

According to Morningstar Research India, the cost gap compounds significantly over time, which means passive investors often end up richer in the long run.

It’s no surprise that flows into ETFs tracking indices like Nifty 50 and Sensex are surging, while active large-cap funds are losing charm.

Why Does This Matter to You?

If you’re an investor in large-cap funds, this shift raises important questions:

- Are you paying more for less?

- Should you consider moving part of your portfolio to low-cost index funds?

- Do you still believe in active managers’ ability to generate long-term alpha?

For many retail investors, especially those who want steady returns without drama, passive options are now looking attractive.

The Silver Lining

Not all is lost. Large-cap funds still offer:

- Diversification: A basket of India’s top companies in one place.

- Stability: Less volatile than mid-cap or small-cap funds.

- Professional Management: While alpha may shrink, managers still handle portfolio rebalancing, dividends, and regulatory compliance.

In other words, they’re still useful—but they’re no longer the “hero” funds. They’ve become more like reliable supporting actors.

Large-cap funds: still safe, still steady, but not exactly spicy anymore.

What Should Investors Do?

- Review Costs: Compare your large-cap fund’s expense ratio against ETFs or index funds.

- Diversify Across Categories: Don’t park everything in large-cap. Balance with mid-cap, small-cap, or hybrid funds for growth potential.

- Think Long-Term: If you already hold a good large-cap fund with consistent performance, don’t panic-sell. Use it as part of a diversified strategy.

- Learn About Passive Investing: As SEBI and AMFI emphasize, understand the product before investing.

Are you team Active or team Passive? Share your investing style in the comments. If you’ve shifted to ETFs, tell us why—and maybe inspire someone else to rethink their portfolio.

Related Post Suggestion

“Equity MF Flows Dip 21% in August: What’s Brewing?”