India’s sovereign credit rating upgraded to BBB+ by Japan’s R&I. What it means for the economy, investors, and your wallet.

- The Big News: India Gets a Credit Glow-Up

- Why This Upgrade Matters

- What’s Driving This Upgrade?

- A Little Spice: The GST Factor

- Investors, Take Note!

- Comparing with Other Agencies

- What’s in it for the Common Citizen?

- The Road Ahead: Mid-6% Growth & Beyond

- The Fun Flip Side

- What Experts Say

- Authoritative Reference

- Related Post Suggestion

Remember that feeling when your teacher finally bumped your grade from “B” to “B+”? That’s exactly what just happened to India’s economy. And let’s be honest—this B+ feels like an A+ party!

The Big News: India Gets a Credit Glow-Up

Japan’s largest rating agency, Rating and Investment Information (R&I), has upgraded India’s sovereign credit rating from BBB to BBB+. For those who don’t speak the language of credit nerds, let’s break it down:

A sovereign credit rating is like a country’s financial report card. A higher grade means investors trust the nation’s economy, making it easier (and cheaper) for the country to borrow money. Think of it as India getting a VIP pass to the global money club.

Why This Upgrade Matters

This is not a one-off. It’s the third rating upgrade for India in 2025 after global giants like S&P and Morningstar DBRS gave their thumbs up. The consistent upgrades tell us one thing: the world is watching India, and it likes what it sees.

Here’s what the BBB+ upgrade brings to the table:

- Cheaper Borrowing Costs: Government and businesses can borrow money abroad at lower interest rates.

- Investor Confidence: Global investors see India as less risky, which means more dollars flowing in.

- Economic Reputation: India is no longer the cautious kid in the class—it’s moving up the ranks.

For context, credit ratings from Moody’s, Fitch, and S&P are often treated like the holy trinity for global investors. With Japan’s R&I now joining the cheer squad, India’s credit outlook is shining bright.

What’s Driving This Upgrade?

R&I gave several reasons for the upgrade, and they read like a love letter to India’s economic progress.

- Robust Economic Growth – India posted a growth of 7.8% in the April-June period, outpacing expectations. For comparison, most developed economies are struggling to hit 2%.

- Fiscal Discipline – Tax revenues are rising, subsidies are being managed, and debt is under control.

- External Stability – A modest current account deficit, strong remittances, and healthy forex reserves keep India’s balance sheet looking good.

- Resilience Amid Global Shocks – Despite global headwinds like inflation, wars, and US tariffs, India has shown economic muscle.

As the agency put it, India is “one of the most dynamic and resilient major economies in the world.”

A Little Spice: The GST Factor

From September 22, GST cuts come into effect, which will cushion the impact of external shocks like the US tariffs. In simple words—less tax pain, more spending power. This also reduces the risk of inflation biting too hard.

Investors, Take Note!

For overseas investors, a BBB+ rating is more than a symbol. It’s like a green light flashing “Safe to Invest!” Lower borrowing costs mean Indian companies can expand faster, and more foreign direct investment (FDI) could be knocking at the door.

This matters because FDI isn’t just about money—it brings technology, jobs, and global credibility. Already, India has seen a surge in investments in tech, infrastructure, and manufacturing. This upgrade will only accelerate that trend.

Comparing with Other Agencies

Let’s see how India stacks up with global watchdogs:

- S&P: Upgraded India to BBB from the lowest investment grade.

- Morningstar DBRS: Raised India to BBB (from BBB low).

- Moody’s & Fitch: Still cautious, holding India at the lowest investment grade.

Translation? Some global agencies are still warming up to India’s story. But with three upgrades in one year, the narrative is clearly tilting in India’s favor.

What’s in it for the Common Citizen?

You may ask, “Cool, but how does this rating change affect my chai-pakora life?” Here’s the deal:

- Cheaper Loans in the Long Run: As borrowing gets easier for businesses, banks might eventually pass on the benefit to consumers.

- More Jobs: With FDI inflows, sectors like manufacturing, IT, and startups will see growth, creating more employment.

- Stable Rupee: Stronger investor confidence means less pressure on the rupee, which is great for imports and travel.

So yes, even your international holiday plans could secretly thank this credit upgrade!

The Road Ahead: Mid-6% Growth & Beyond

R&I expects India’s growth to remain in the mid-6% range from FY26 onwards. This will be powered by:

- A young, growing population

- Infrastructure push

- Public investment in roads, railways, and ports

- Better economic policies

All these factors align with India’s big dream—becoming a developed nation by 2047.

India’s credit rating just went from “meh” to “wow”—and the world is finally giving us the respect our economy has been flexing for years!

The Fun Flip Side

While upgrades are exciting, let’s not forget Moody’s and Fitch are still playing hard to get. They’re waiting to see if India can continue fiscal discipline, control inflation, and reduce external vulnerabilities.

The challenge for India now is not just to celebrate this rating bump but to climb further up the ladder. After all, the ultimate goal is an A rating, where borrowing becomes even cheaper and investor confidence skyrockets.

What Experts Say

Global economists often treat rating upgrades as both a recognition and a test. One expert noted, “Credit upgrades don’t just open doors to cheaper borrowing; they put pressure on governments to maintain reforms.”

That’s the thing—ratings are not gifts; they’re rewards for consistent performance.

Authoritative Reference

To understand sovereign ratings better, the International Monetary Fund (IMF) explains how they shape investor sentiment and economic policy.

Related Post Suggestion

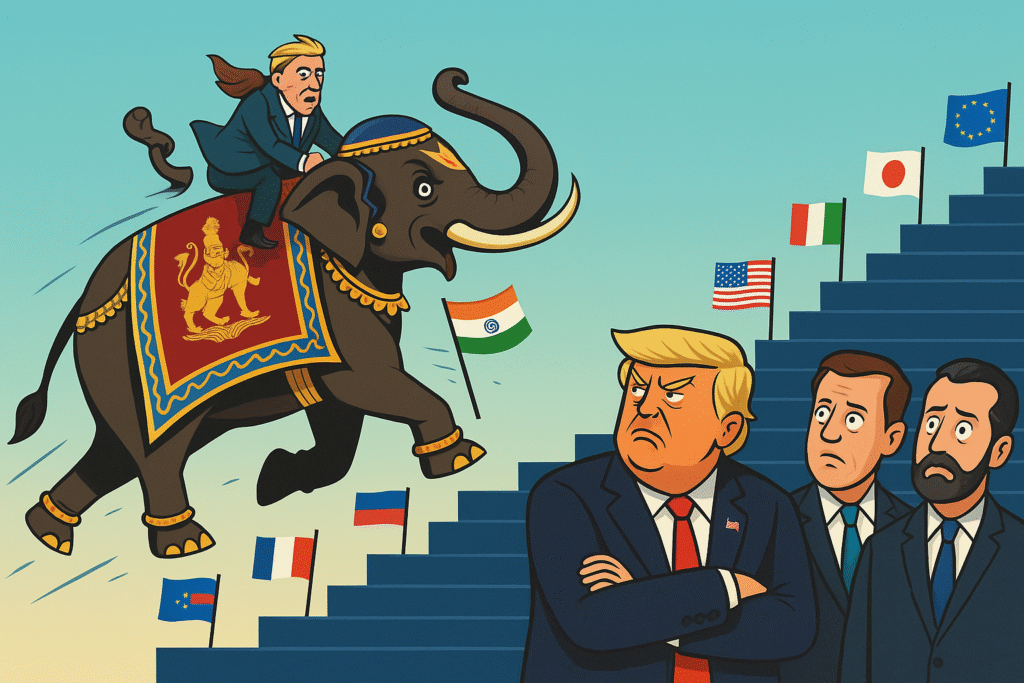

“Elephant on Steroids: India’s Economy Smashes 15-Year Record” – A deep dive into how global money is flowing into Indian startups, factories, and infrastructure.

India’s sovereign credit rating has climbed a notch, and the journey has just begun. Do you think India can secure an A rating in the next five years? Share your thoughts in the comments below!

And hey—don’t just read and scroll. Pass this blog on to your friends, WhatsApp groups, and LinkedIn circles. Because good news is best enjoyed when shared!